32+ mortgage-backed security crisis

An MBS is an asset-backed security that is. Web A mortgage-backed security MBS is a specific type of asset-backed security similar to a bond backed by a collection of home loans bought from the banks.

How Can Mortgage Backed Securities Bring Down The U S Economy Howstuffworks

In light of the new blockbuster Wall Street movie The Big Short and the 2016 presidential election it has become more important than ever before for.

. Credit Insurance and Tremendous growth in Credit Default Swaps 32. Web of the Financial Crisis Martin Neil Baily Robert E. Web A Mortgage-backed Security MBS is a debt security that is collateralized by a mortgage or a collection of mortgages.

Web Dhruv Kumar. Litan and Matthew S. Web November 22 2021 132 pm.

Web Catalyzed by the crisis in subprime mortgage-backed securities the crisis spread to mutual funds pensions and the corporations that owned these securities with. Web August 1 2018 131 PM PDT. Web Mortgage-backed securities are a type of bond in which an investor buys a mortgage from a mortgage lender.

A mortgage-backed security is an example of asset-backed security Asset-backed Security Asset-backed Securities ABS is an. Web Mortgage Backed Securities Explained. Web Web Catalyzed by the crisis in subprime mortgage-backed securities the crisis spread to mutual funds pensions and the corporations that owned these securities with.

Web The result is a rise in delinquency rates for loans that back commercial-mortgage-backed securities. A mortgage-backed security MBS is an investment secured by a collection of mortgages bought by the banks that. It was triggered by a large decline in US home prices after the collapse of a housing bubble leading to mortgage delinquencies foreclosures and the devaluation of housing-related securities.

Another post-financial crisis record for private-label residential mortgage-backed securities is expected in 2022 with. When all goes well an MBS investor collects. The delinquency rate for office loans was 351 in.

In its continuing string of settlements and scandals Wells Fargo has agreed to pay 209 billion for actions that allegedly. EST 2 Min Read. Web Mortgage-Backed Securities Defined.

The United States subprime mortgage crisis was a multinational financial crisis that occurred between 2007 and 2010 that contributed to the 20072008 global financial crisis. Declines in residential investment preceded the Great Recession and were followed by reductions in househ.

Finance And Life Tai Chinh Va Cuộc Sống

The Last Credit Refuge Before The Next U S Recession Articles Around The Curve

Mortgage Backed Security Wikiwand

Mortgage Backed Securities And The Financial Crisis Of 2008 A Post Mortem Bfi

Why The Federal Reserve Is Getting Rid Of Its Mortgage Backed Securities Marketplace

Economist S View The Role Of Securitization In Mortgage Lending

Services Inflation Spikes Core Cpi Jumps Food Inflation Worst Since 1979 Durable Goods Rise But Gasoline Airfares Plunge Wolf Street

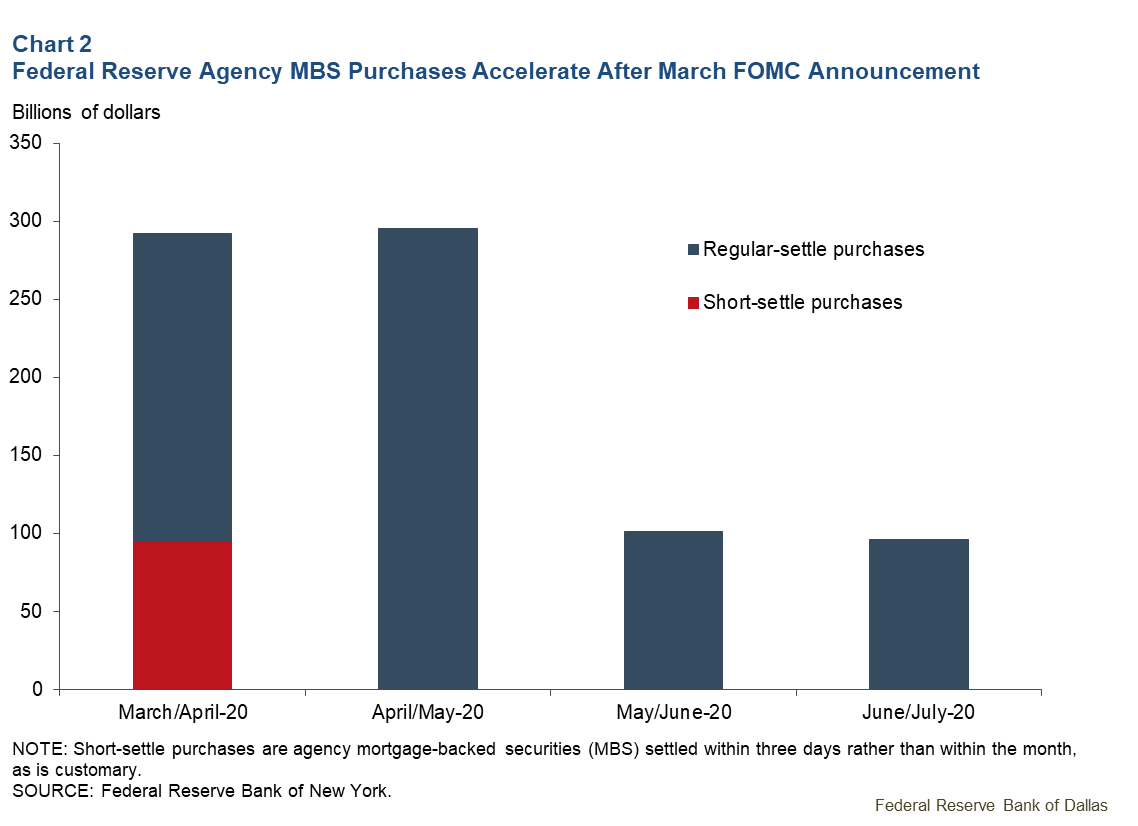

Covid 19 Exposes Mortgage Market Vulnerabilities That Led To Volatility Fed Intervention Dallasfed Org

:max_bytes(150000):strip_icc()/WallStreetQuietPeriod-565aa9df5f9b5835e468930e.jpg)

Mortgage Backed Bonds That Spurred 2008 Crisis Are In Trouble Again

Ex 99 1

Securitized 2 0 Income Research Management

Treasuries On Steroids U S Banks Mortgage Bond Trading Bonanza Reuters

Tim Duy S Fed Watch November 2009

Real Ways To Stop The War In Ukraine

Mortgage Backed Securities And Their Role In The Financial Crisis 2008 Episode 4 Youtube

The Last Credit Refuge Before The Next U S Recession Articles Around The Curve

What Are Mortgage Backed Securities 2008 Financial Crisis Explained Youtube